Many electric utilities have been intrigued by the idea of offering high-speed broadband to their residents and members as an expansion of their own fiber networks. The need for this service will increase due to the COVID-19 pandemic. Work-at-home, remote schooling, video streaming, telemedicine, and other at-home connections have dramatically increased due to social distancing in response to the COVID-19 pandemic. These increases have highlighted weaknesses in our broadband infrastructure, especially in the rural areas of our country. As a response, we expect federal and state initiatives addressing broadband gaps to increase. The federal and state initiatives are expected to range from increased availability of construction and operating grants to regulatory changes.

Given this new pressure on the broadband infrastructure, we expect that many electric utilities will accelerate their investigation and potential decision to enter the broadband business. However, we fear that many electric utilities may make business decisions that may not be fully vetted and that might have a substantial impact on the viability of the electric utility long-term.

Even in response to the COVID-19 pandemic, it’s important to conduct a thorough broadband feasibility study and to carefully weigh some key considerations that impact the broadband business.

On the following pages, we present key considerations for a successful fiber-to-the-premises (FTTP) evaluation and implementation. Referred to as the “Tipmont 10,” these considerations were developed and used by Tipmont REMC in planning and deploying their broadband business. Whether you’re considering, planning. deploying, or running a broadband business, leveraging the Tipmont 10 can assist you with this new business venture.

The Tipmont 10

Tipmont REMC (Tipmont) of Linden, Indiana serves 23,000 consumers between the cities of Lafayette and Crawfordsville. Recently, Tipmont has entered into the broadband business. As indicated in the March 6, 2019 “Broadband Internet, Tipmont News,” the decision was driven by reshaping the cooperatives’ mission. In 2015, Tipmont’s board of directors and leadership began an initiative to rethink the cooperatives’ mission and purpose. In a time of rapid change, or even disruption in the energy business, the time was right for some soul searching.

As a result, the board concluded that Tipmont is in the security, comfort, and convenience business – not necessarily just the electric business. Tipmont began to measure their success in terms of the community’s economic health in addition to more traditional measures. Electricity is vital to security, comfort and convenience – but in the end, is that enough?

Tipmont management concluded the exercise with a new mission statement: “Empowering our communities with state-of-the-art essential services.” This mission reflects that Tipmont’s role is larger than simply providing distributed electric services.

Tipmont’s new mission allowed the cooperative to reimagine nearly everything they do. It encouraged Tipmont to take a leadership role beyond just the consumers they serve, making meaningful and positive change through economic development efforts, education, and outreach. A key part of the new role was consideration of offering broadband services to their membership.

In development of the broadband plan, Tipmont management followed ten key principles – referred to as the “Tipmont 10.”

You may be hearing from your consumer base that there is a significant demand for broadband. In some cases, this might be true. But be cautious of estimating the true demand based on these unsolicited comments. They may be representative of a vocal minority, and they comprise a self-selected sample. Many consumers are satisfied with lower-end broadband service such as DSL, even under the pandemic response; not all consumers have school-age children or can work at home.

If you enter the broadband market, you must ensure that your staff, management, and board are ready to operate in a competitive business. Understand that the top three activities in the broadband business are sales and marketing, sales and marketing, and sales and marketing! This is foreign to most electric utilities.

Customer service offerings to support broadband are also significantly different than those of the daily customer service offerings to support the utility and require different skills. Customers don’t usually call the electric utility when their toaster isn’t working, but with broadband offerings, customer service calls could become that granular.

Electric utilities have a monopoly service area, and electricity is an essential service. Electric utilities have virtually a 100 percent take rate. Cost recovery is accomplished by setting rates that are based on recovering investment and expenses. In broadband, the provider must set a service price that is a balance of demand at a given price. This balance is impacted by competitive pressures and individual consumer preferences. Acting as a broadband utility that has a monopoly service area without competition could be a financial disaster in a broadband offering.

Meanwhile, your electric operation should be humming along smoothly in financial and operational health. The new broadband service venture will require time and effort from your staff so the regular utility operations must be in a good position to withstand the growing pains. Have a strategic planning and performance management system in place if possible.

It’s also a good time to review all your policies—think defense. The new broadband offering will bring your utility more attention that you may have had in decades, and it’s important to prepare accordingly to prevent getting derailed.

Finally, set your cash flow objectives and goals. In the mid-term, at best, this is a break-even operation, and your utility will need to be prepared to cover early losses.

Generalized assumptions yield generalized results—so make sure your study is tailored to your specific needs and situation, using utility-specific data, not boilerplate estimates based on national or regional averages. Your study should include capital construction cost estimates (including make-ready and easement perfection) and operating cost estimates.

As part of the feasibility study, you may elect to perform a demand-side market analysis, which requires segmentation, and possibly including a detailed market survey of residents. Remember that the vocal minority do represent a minority, so it’s a good idea to understand the real scope of the demand across your customer base. If you choose, you may defer the market survey to the business planning or other later stage, in order to avoid raising customer expectations too early.

Recognize that a feasibility study is not a business plan. A feasibility study gives you a sense of risks and opportunity, whereas a business plan gives you direction on execution. Your staff will need to direct both.

Your competition has better economies of scale, so while you consider offering competitive pricing, it’s important to remember that your competition will likely win a price war.

Lastly, do not turn over core operations to a management firm. Just imagine what your electric business would look like if this was done when municipal and cooperative electric utilities emerged.

The assumptions made are critical: the feasibility model does not correct, modify, or shape the assumptions made. Instead, the assumptions drive the financial projections.

Remember that just because you may be enamored with broadband does not mean all residents and households are. Many households are happy with a data connection of 10 Mbps or less. Many households will just use a smart phone for their data connection (about 20 percent nationwide today). And some households will choose not to acquire any service.

Bad debt is real. You will need to be prepared to recognize and cut off bad payers. And finally, don’t let your governance board make operating decisions.

A common mistake that has led to some of the failures is adding the same inflation factor to revenues and expenses, which can make a bad feasibility model look good. With long-term capital intense projects such as FTTP, applying inflation can project substantial net revenues that are not obtainable.

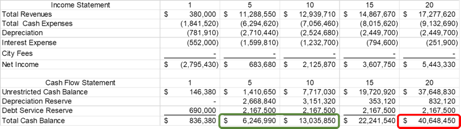

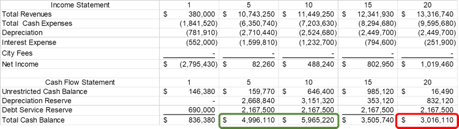

In the calculations shown below, the table on the top uses the same inflation percentage on expenses and revenues. By contrast, the bottom table uses a lower inflation percentage on revenues, which results in relatively flat net revenues (net revenues historically with broadband have remained relativity flat). All other assumptions are the same.

As seen in the first table, net income rises steadily throughout the projection. In the second table, net income increases, but at a substantially lower rate. The difference in the resulting cash balances between the tables leaps between year 5 and year 10 (circled in green). This is due to the compounding on the net revenues (revenues less expenses) when the same inflation factor is applied to revenues and expenses. At the end of year 20, the difference between the projections is almost $38 million (circled in red).

The financial analysis needs to present a year-by-year income statement, cash flow statement, capital addition summary that follow accounting standards. Look carefully at cash flow, not just a Net Present Value (NPV) or an Internal Rate of Return (IRR) calculation. A projection can show a high 20-year IRR and have negative cash flows for the first 10 years, especially if inflation factors are misstated or misused. Also, clearly understand any allocations to electric utility capital or operations.

Finally, as stated above, a spreadsheet does not correct, modify, or shape assumptions made. The assumptions drive the projections. It is critical that you understand every assumption, its basis, and how the assumption is treated in the model. If you use a consultant, make sure that you are provided a working copy of the financial model.

Entering into the broadband business might be the correct choice for your utility, or it may be a high-risk venture. Conducting a study that incorporates the above steps can help determine the best approach for your utility. In the case of Tipmont, their entry into the broadband business followed methodical planning and preparation based on the above steps and included an acquisition of a competitive local exchange carrier (CLEC) and the development of a partnership with a local telephone cooperative. They are well underway in deploying broadband to their consumers.

Again, the only difference between the models is how inflation is treated. It’s amazing how a single assumption that is often treated as an afterthought can impact the projections.