By Harry John, Ph.D. Economics, Lead Forecaster, Power System Engineering

Contributors:

Rich Macke, Vice President, Economics, Rates and Business Planning

Elena Larson

Shaurice Moorman

Tom Butz

Nick Nelson

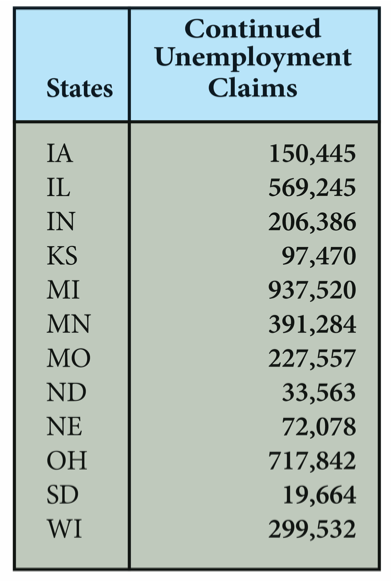

Midwestern states’ economies have been severely impacted by businesses stoppage due the COVID-19 pandemic lockdowns. The shutdown of businesses has led to over 3.7 million unemployment claims in the region, as of the end of April (see Table 1). Unemployment claims are the highest in Michigan and Ohio, with key steel and auto industries closures. The pause in economic activities is compounding an already fragile Midwest economy beset by a weak agricultural sector and dwindling oil prices.

Power System Engineering (PSE) estimates Midwestern states’ real gross domestic product (RGDP) to decline between 2.8% to 5.5% in the first quarter of 20201 as a result of business closings. The anemic economic conditions predicted in the first quarter of 2020 will remain until the second quarter 2021, when moderate growth is expected.

Figure 1: Midwest States’ Continued Unemployment Claims as of April 29, 2020

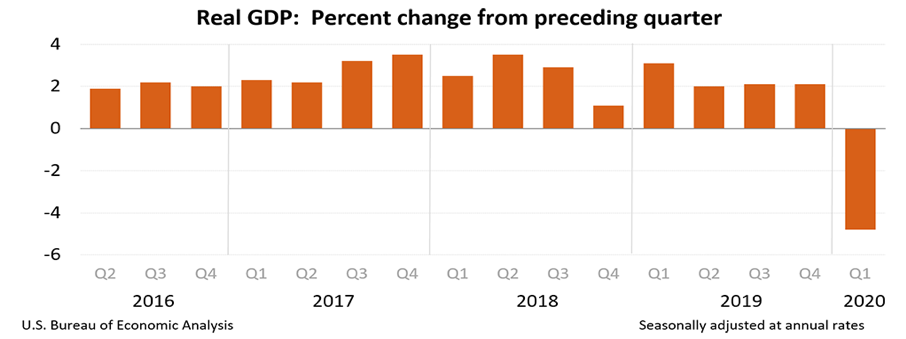

Many regions are experiencing slow economic activities, as unemployment claims surge due to the stoppage of business activities. The cessation of businesses across the country has impacted the nation’s economy, as first quarter real gross domestic product declined 4.8%. The Bureau of Economic Analysis reported April 29 that the nation’s economy declined for the first time in more than a decade (see Figure 2, below).

Figure 2

Although the GDP estimate portrays a weak economic condition, it was based on incomplete data that are subjected to further revision. The “second” estimate for the first quarter, based on comprehensive data, will be released on May 28, 2020. The deteriorating economic activities and growing job losses resulting from business shutdowns are certain to have an impact on the energy industry.

Electric providers across the nation will be impacted as many businesses pause activities due to COVID-19, resulting in less energy consumption and peak demand. The magnitude of the impact to electric providers will largely depend on the their customer mix, e.g. residential versus industrial, and commercial, and/or the key industries served. Electric providers that depend largely on industrial and commercial customers for a sizable portion of its revenues will tend to be impacted the most.

The Impact on Electric Energy and Demand

Many regions are experiencing reduced energy consumption and peak demand, with the potential for revenue losses. Economists and energy experts are of the belief that this will impact investor-owned, municipal and cooperative utilities.

Energy experts project some electricity providers – depending on states, region, and customer mix – could experience a 3% to 6% decline in energy consumption and roughly 2% to 4% drop in peak demand.

What Are the Plans for Utilities Going Forward?

The length of businesses shutdown and the extent of the lasting impacts are uncertain. PSE experts have been consulting with clients and staying engaged to prepare for the changes that may affect electric providers going forward.

Below are some examples of what PSE is seeing/hearing from our clients:

Depending on the situation, PSE experts are suggesting:

Power System Engineering (PSE), is a full-service consulting firm for electric utilities, independent power producers, industrial facility owners, energy resource developers, and more. Since 1974, we have provided industry-leading engineering, economic, and planning solutions to utilities of all types.

PSE is committed to uniting proven approaches with innovative solutions.

References:

S&P Global Report March 19, 2020.

Utilities beginning to see the load impacts of COVID-19 as economic shutdown widens, Emerging solutions, Rocky Mountain Institute (RMI), March 23, 2020.

North American power market seen disrupted for at least 18 months, Rocky Mountain Institute (RMI), April 9, 2020.

Brattle Economic Assessment April 14, 2014.

Managing the Impacts of COVID-19 on Power and Energy with Demand Response, March 2020, Load Management Group.

COVID-19 Bulk System Impacts: Demand Impacts and Operational and Control Center Practices, Electric Power Research Institute (EPRI), March 27, 2020.

Electric Cooperatives Face $10 Billion in Lost Revenue from COVID-19, NRECA, April 22, 2020.

Bureau of Economic Analysis

St. Louis Federal Reserve Bank (FED St. Louis Database)